Hello Tomorrow Today readers and welcome to the Big 5️⃣!

You might have noticed Notes like this popping up in your Substack feed:

Many of you reached out to let me know how useful these notes were. The problem is that these updates don’t really fit well with Substack’s Notes feed. That’s why I decided to migrate them to a separate newsletter.

Every week I’ll share big economic news updates with you. I’ll add commentary about why I think these stories are important. And when it makes sense to, I’ll recommend courses of action you can take.

I’d love to know what you think about today’s newsletter. Feel free to share your thoughts in the comments.

P.S. if this isn’t your jam or you’re subscribed to way too many newsletters, I get it. This is just a way to share economic news within Tomorrow Today. If you don’t want to receive this update, follow these steps to toggle it off.

The Big 5️⃣ Economic Stories To Keep on Your Radar

1️⃣ More Companies are Adopting AI First Policies

Duolingo will start replacing contractors with AI. In a post published on LinkedIn, CEO Luis von Ahn wrote that AI will be used to increase the volume of content the company creates.

Duolingo is the latest of a growing number of companies adopting AI-first policies. Last month, Shopify CEO Tobi Lutke wrote on X that employees will need to prove that AI can’t do a task before asking for additional resources. And Wall Street is already making entry-level jobs obsolete.

AI isn’t literally taking jobs at this point. It’s reducing the number of new job opportunities that will be created in the future and it’s becoming a requirement for continued employment.

Note that both Duolingo and Shopify will begin incorporating AI competency into their annual review process. Basically, if you don’t take it upon yourself to start learning AI, you aren’t developing the skills these companies clearly want. This could be grounds for termination in the next year or two before AI actually takes over your job.

👉Learning AI now will keep you valuable to your company and increase your demand as a worker later on.

To be AI literate, every knowledge worker needs to be competent with the following skills:

Basic understanding of what AI is and how it works

Proficiency with AI chatbots and data visualization tools

Knowledge of how to integrate AI tools into everyday tasks

Data literacy to develop training sets for AI

These are some online courses you can take now to get started:

Google AI Essentials (I actually started this one yesterday. Let me know if you’d be interested in a review of it.)

👉Create a portfolio to document your AI skills.

After you establish AI competency, I’d recommend creating a portfolio for yourself. Build a website using your name as the domain and publish examples of your work. We’re moving into a post-resume world where employers want real proof you can do what you say you can do. A portfolio with personal projects or freelance client work is the best way to do showcase your skills.

I use Squarespace. There is a monthly fee but it’s an all-in-one platform that’s easy to use. It also includes scheduling and ecommerce capabilities. If you want to start freelancing or have digital products to sell, you can add those things to your site.

2️⃣ Shortages Are Coming and That Will Probably Result in Job Losses

The Trump Administration’s tariff policy is beginning to impact global supply chains. Shipping container company Hapag-Lloyd reports customers have canceled 30% of orders from China to the United States and toymakers warn of shortages this Christmas.

Disruption of this scale will likely lead to shortages as manufacturers pull back production and look for alternative suppliers.

The media talks about tariffs as a tax on consumers, but it’s not just about things becoming more expensive. The fewer goods there are on store shelves, the fewer people that will be needed to move and process those goods. The fewer people that are needed, the less people companies will need to employ. Here are some jobs that could be effected as a result of tariffs:

Dockworkers who process inbound cargo ships

Truck drivers who transport inventory around the country

Warehouse workers who receive and store products

Delivery drivers who provide last mile delivery services (unrelated to product shortages but UPS recently announced 20,000 job cuts)

Retail workers who stock shelves

This will affect communities differently. It could be more disruptive in some places than others depending on how dependent a local economy is on the transportation and sale of Chinese-made consumer goods.

👉Be aware of the second and third order consequences of tariffs.

It’s not just about the cost of goods going up. Workers who are employed in the supply chain that moves goods from manufacturer to end-consumer will also be impacted.

3️⃣ The Housing Crisis Could Get Much Worse

Housing is a core part of U.S. GDP and it is a major expense for most U.S. households. Whatever happens in the housing market is going to affect the rest of the economy.

CNBC reports that mortgage interest rates are up while applications are down. The reason: economic volatility.

This is happening just as millions of Americans are about to become less creditworthy. Things could go from bad to worse, especially for potential first-time homebuyers.

Next week, the Department of Education will resume collection of defaulted student loans. Millions of borrowers could see their credit scores plummet. Wage garnishments could make it harder for borrowers to pay existing debts – including mortgages.

Landlords and banks can legally discriminate on the basis of credit, as can employers. Depending on how it’s handled, this could create an acute affordability crisis in some high cost of living cities.

👉Even if you don’t have student loans, this could affect you

Housing is a contagious market. This will keep new buyers on the sidelines while foreclosures could result in lower property values. Even if you’re opposed to student loan forgiveness, you have an interest in young people being able to buy homes.

Buyers who purchased a home in the last five years could find themselves underwater as the housing market continues to sour. This could prove difficult to refinance at a lower rate and/or retirees banking on the value of their home could find it’s not worth as much as they thought it would be.

👉 But the housing market isn’t bad everywhere

The housing market isn’t doing too well and student loan borrowers are definitely in a pickle, but there are still options.

Lots of communities still have affordable homes. I grew up in a Rust Belt town in Upstate New York. These are actual homes for sale on Zillow right now:

Is there a lot happening in this part of New York? No. Has there been a brain drain because of deindustrialization? Absolutely. But is there affordable housing here? You bet.

Student debt or not, there are options out there to become a homeowner. Buyers just have to be willing to seek those options out. Whether you’re looking to buy or looking to invest, keep an eye out for domestic migration as people move to areas with affordable housing.

4️⃣ We’re Not Prepared for Grid Collapse

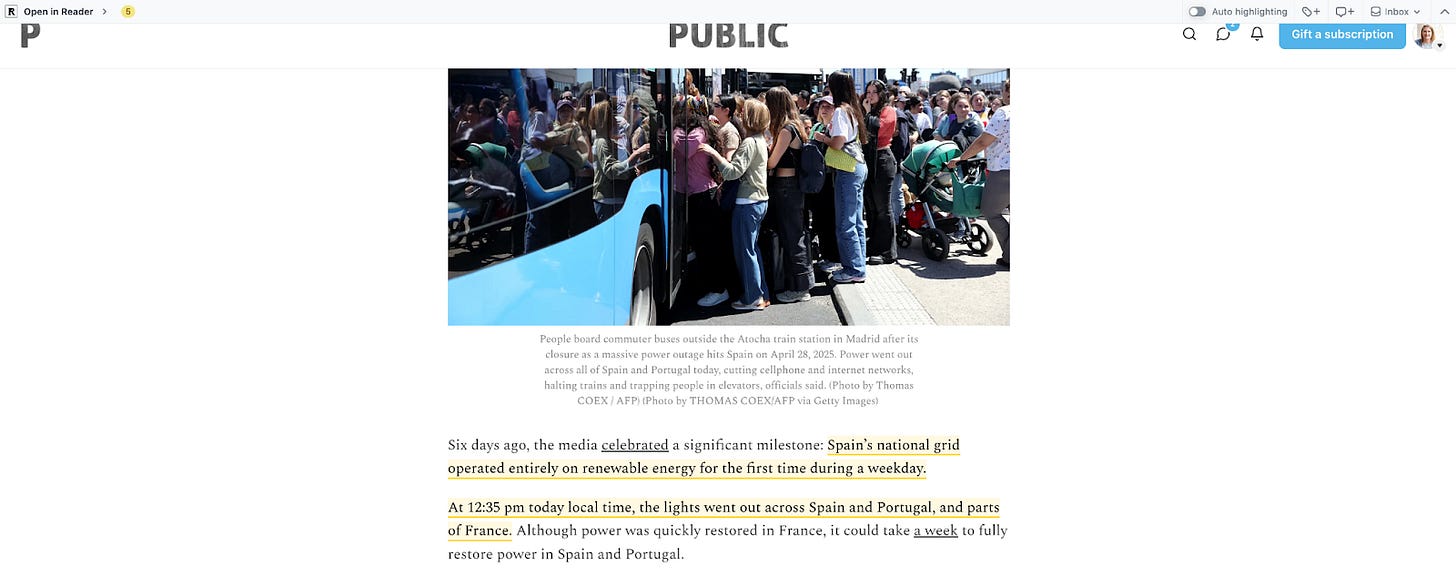

Last week, the power went out in Spain. Michael Shellenberger covered the collapse in

:In an instant, the electric hum of modern life — trains, hospitals, airports, phones, traffic lights, cash registers — fell silent. Tens of millions of people instantly plunged into chaos, confusion, and darkness. People got stuck in elevators. Subways stopped between stations. Gas stations couldn’t pump fuel. Grocery stores couldn’t process payments. Air traffic controllers scrambled as systems failed and planes were diverted. In hospitals, backup generators sputtered on, but in many cases could not meet full demand. Cell towers collapsed under surges and outages.

The cause of Spain’s blackout is debated. Shellenberger argues it’s the physical fragility of renewable energy systems. Other possibilities include “induced atmospheric vibration” or deliberate sabotage (although the Spanish government has ruled out a cyberattack).

Regardless of what caused the blackout, the more interesting thing is what happens after a blackout occurs. As Shellenberger notes, every facet of modern life shuts down during a blackout. Loss of digital infrastructure – communications, banking, electrical pumps, and transportation systems – can bring modern civilization to a grinding halt.

While the transition to renewable sources of energy may be good for the environment, there are challenges that come with the transition. A blackout here or a blackout there will result in periodic disruptions. But consistent blackouts can make it difficult for you to work much less keep an economy going.

👉Anticipate the risks of the green energy transition

Whether you’re a business or a remote worker, blackouts can trigger massive economic disruption. It doesn’t matter whether it’s a physical failure of the grid, political incompetence like what’s happening in South Africa, or a natural disaster, anyone can be affected by blackouts.

If you don’t have a plan, now might be a good time to develop one. Green energy production will likely continue to increase in the coming years which means the risks for blackouts will rise. Growing dependence on digital banking and remote work could leave you in a really bad situation if a Spain-like blackout occurs in your neck of the woods.

Will Internet Outages Plunge Us Into a Digital Dark Age?

Hurricane Beryl recently barreled into Texas. While it wasn’t the worst hurricane Texas has seen, it wasn’t just another storm either.

5️⃣ 60% of Coachella Tickets Were Financed

Coachella is a two-weekend festival held every April in Indio, California. Some people go for the music. Most people go for clout on the Gram.

General admissions passes start at $549. This doesn’t include the cost of flights, local shuttles, camping/hotels, food and drink, and other discretionary expenses like clothes and merch.

According to reporting from Billboard, 60% of this year’s Coachella tickets were financed using payment plans. Aside from Klarna and PayPal Later, Coachella offers its own payment plan.

Conveniently, 2026 Coachella passes went on sale right as I was drafting this newsletter. I pretended to buy a pass to see how it works.

Attendees pay $49 down with eight monthly installment payments thereafter. This includes a $55 fee for the privilege of using the installment plan option. When all is said and done, financing a $549 pass ends up costing you $120 more.

The proliferation of new installment-based financing options signals greater financialization of the economy. Consumers are becoming increasingly reliant on credit rather than cash to finance their lives while businesses are tacking on extra fees to boost their revenue. This is a bubble that’s eventually going to burst.

👉Audit your spending.

As the economy transitions debt is going to be harder and harder to manage. The goal for most Americans right now isn’t to become uber wealthy. It’s to pay for things in cash to avoid going into even more debt.

If you don’t have a habit of analyzing your spending, make a habit out of it. I have a weekly finance check-in on my calendar for every Friday. The goal of doing this is to make sure I’m spending less than I earn.

Knowing how much money comes in each month and how much goes out is essential. It will be difficult to adapt in the economy if you don’t have this information.

I personally use Tiller Money to evaluate my spending. It’s a spreadsheet based budgeting tool with all sorts of charts and dashboards. If you don’t already have a preferred budgeting tool, you can try it out for free.

I do a lot of research for Tomorrow Today. This involves a ton of reading – books, articles, PDFs, you name it.

I use Readwise to help me aggregate all of my notes in one place. The Readwise Highlighter is a Google Chrome plugin that makes it easy to highlight, tag, or take notes on important information right from my web browser.

And Readwise’s AI-powered chat feature allows me to create summaries from my highlights. This means I can take highlights from Kindle books and analyze them alongside recent news articles like Michael Shellenberg’s piece in Public.

Understanding how to extract, organize, and take action from new information you learn is a vital skill. Readwise is a tool that helps you do just that. Tomorrow Today readers can test out Readwise and its Reader app for 60 days.

Last Week’s Subscriber Articles

Tesla Robotaxi Will Kill Uber – Gig Workers Aren’t Ready for It

Mass produced cars are arguably one of the most important inventions of the 20th century.

Women Shouldn’t Work Outside the Home Anymore

Feminism promised to liberate women from domestic life. Instead, it imprisoned them.

💡What Do You Think?

As I mentioned, this is a bit of an experiment based on some of my Notes. I’d love to know what you think and if you found value in today’s newsletter. Feel free to share your thoughts in the comments.

Tomorrow Today is a member of several affiliate programs including Amazon’s. If you click a link and make a purchase, Tomorrow Today may earn a commission. Thanks for your support.

I love the newsletter format. I can scroll through fairly quickly and then click on articles I want to read.