1️⃣ One Big Not So Beautiful Bill

2️⃣ New Jobs…Not So Fast

3️⃣ A $30 Minimum Wage is Coming to LA, Possibly New York

4️⃣ Corporations Are Coming to Harvard

5️⃣ Amazon Employs Its 1 Millionth Robot

1️⃣ One Big Not So Beautiful Bill

On Thursday, the House passed the One Big Beautiful Bill.

At 887 pages, no one has actually read it. The bill includes a variety of measures including tax cuts, new work requirements for Medicaid, and funding for increased border security.

There’s so much packed into the bill, it’s hard to know what’s what. I asked Grok to summarize the key points in it. Here’s what Grok had to say:

Tax Policy Reforms:

Extension of 2017 Tax Cuts and Jobs Act (TCJA): Permanently extends individual tax rates (10%, 12%, 22%, 24%, 32%, 35%, 37%), increased standard deductions, and the repeal of personal exemptions from the TCJA.

Child Tax Credit: Increases the child tax credit to $2,200 per qualifying child (Senate version, compared to $2,500 in the House version through 2028, reverting to $2,000 in 2029). Requires only one parent to have a Social Security number in the Senate version.

No Tax on Tips and Overtime: Introduces a temporary deduction for tip wages and overtime pay, phasing out based on income ($150,000 for individuals, $300,000 for joint filers), expiring in 2028.

State and Local Tax (SALT) Deduction: Raises the SALT deduction cap from $10,000 to $40,000 for five years (Senate version, compared to 10 years in the House version), benefiting high-tax state residents.

Business Tax Provisions: Makes permanent expensing for short-lived assets and domestic R&D, increases Section 179 expensing to $2.5 million, and modifies interest deduction limitations. Reduces green energy tax credits from the Inflation Reduction Act (IRA) by about $500 billion over a decade, repealing credits for electric vehicles and residential energy products.

Other Tax Measures: Introduces an excise tax on certain remittance transfers, taxes on university endowments, and eliminates a $200 tax on gun silencers and short-barreled firearms.

Spending Cuts and Reforms:

Medicaid Reforms: Imposes work requirements for able-bodied adults (80 hours/month of work or community service starting December 2026), shifts re-enrollment to every six months, and reduces provider taxes in Medicaid-expansion states to 3.5% by 2031. Eliminates eligibility for undocumented immigrants and those with temporary immigration status.

Supplemental Nutrition Assistance Program (SNAP): Tightens work requirements for able-bodied adults without dependents, adjusts the Thrifty Food Plan to limit cost increases, and imposes state cost-sharing based on payment error rates. Estimated to cut SNAP spending by $267 billion over 10 years.

Student Loan Programs: Reforms include $330 billion in cuts, loan rehabilitation, and delays in rules for borrower defense and closed school discharges.

Non-Military Spending Reductions: Cuts non-military discretionary spending, with estimates of $1.5–$2 trillion in savings over a decade, offset by increased economic growth in some claims.

Border Security and Immigration:

Funding Increases: Allocates $350 billion for border security, including $46 billion for the U.S.-Mexico border wall, $45 billion for 100,000 migrant detention beds, and significant funding for ICE (increasing from $10 billion to over $100 billion by 2029), Border Patrol, and deportation operations.

Immigration Fees: Imposes new fees, including a $1,000 asylum fee, and fees for employment authorization and parole.

Policy Changes: Expands detention capacity, deportation operations, and law enforcement training, aiming for 1 million annual deportations.

Defense and National Security:

Defense Spending: Adds $150 billion for defense, including $25 billion for a missile defense shield (“Golden Dome”), $34 billion for naval fleet expansion, and $9 billion for servicemember quality of life.

Other Initiatives: Funds the Artemis moon mission, Mars exploration, and $88 million for a pandemic response accountability committee.

Energy and Agriculture:

Energy Provisions: Repeals IRA provisions raising royalty rates, mandates oil and gas lease sales, expands leasing in the Arctic National Wildlife Refuge, and reduces coal royalty rates to 7% through 2034.

Agriculture: Increases reference prices for crops (e.g., corn, soybeans, wheat), extends 2018 farm bill programs, and modernizes farm programs.

Healthcare and Other Provisions:

Medicare and ACA: Modifies ACA exchanges, prohibits coverage of gender transition procedures as essential health benefits, and provides $25 million for AI to detect Medicare fraud. Provides $50 billion over five years for rural hospitals.

Other:

Establishes a National Garden of American Heroes ($40 million), expands the Radiation Exposure Compensation Act, and creates “Trump Accounts” for newborns with up to $1,000 deposits.

For fiscally responsible citizens, the bill is one big beautiful let down. According to Grok, the Senate version of the bill would increase the deficit by $3.6 trillion – including $705 billion in interest payments – and increase the debt ceiling by $5 trillion.

Kentucky Congressman Thomas Massie is one of only two Republicans to oppose the bill (Rep. Brian Fitzpatrick R-PA was the other). He recently sat down with Theo Von to talk about it:

Politics aside, I want to draw attention to the economic mechanics of the bill.

The national debt is driving the economic upheaval we’re currently experiencing. As of this writing, the national debt just passed $37 trillion. The United States owes a lot of money to a lot of people. This includes foreign countries like China but also retirees receiving pensions.

While the debt itself is inconceivable, I want to draw your attention to a different metric – the debt to GDP ratio. This is similar to your debt-to-income ratio, a metric used by lenders to figure out how risky you are.

Historically, a high debt to GDP ratio was a byproduct of war. Researchers at Yale argue the large growth in Britain’s debt was a catalyst for the Industrial Revolution:

From 1692 to 1815, Britain’s debt rose from 5% to over 200% of GDP. The funds raised were not used to finance productivity enhancing infrastructures, but instead to pay for overseas wars. During this period, Britain was at war for 76 years – 62% of the time. And yet, frequent wars and high debt accumulation coincided with a remarkable transformation of the economy

This makes a lot of sense if you consider the United States was essentially founded as a result of the debt England incurred following the Seven Years’ War with France. Had King George not gone into debt and needed his colonists to pony up, we’d all be sipping tea right now.

According to the U.S. Debt Clock, the current debt to GDP ratio is 123%. Just like the Industrial Revolution, this is likely pushing capital into more productive areas of the economy to foster economic growth.

Want to guess what technology capital is flowing to?

Artificial intelligence.

While this is good for the tech execs building AI businesses – Sam Altman, Mark Zuckerberg, and Elon Musk to name a few – and the venture funds invested in their companies – like Andreesson Horowitz – it’s not so good for Main Street Americans.

Which gets me back to the One Big Beautiful Bill. This is an attempt to put a band-aid on a wound that needs stitches. The bill doesn’t solve any of the problems we face – like the demographic inversion of Social Security. It’s kicking the can down the road yet again.

Historically, structural changes in the economy has meant workers are left behind. The researchers at Yale go on to say:

A third aspect of the Industrial Revolution is limited gains in terms of living standards accruing to the working class. Real wages did not keep up with output growth during the core phase of the industrialization process (1770-1830); the wage share of national income fell sharply, while the share going to capital surged. Our model offers an explanation for this puzzling feature, by showing how massive sovereign borrowing contributed to the divergence between productivity and wages. It is precisely the reduction of labor demand (because nobles switched from low-return investments to sovereign debt) that kept wages low and generated the entrepreneurial profits needed to finance industrialization.

This is likely going to happen to you and me as AI displacement gets underway. Labor demand will drop, capital will flow to AI, wages will drop in turn, and with it the tax base. The problem is as revenues decline due to the loss of the tax base, programs funded by the One Big Beautiful Bill will continue facing cuts.

If you think the political maelstrom is bad now, it’s going to get much worse. AI adoption will likely accelerate to cover the fiscal gaps, exacerbating existing problems rather than solving them.

I’m a fan of Ray Dalio’s work. He’s talked extensively about the risks of public debt and the political impact it has within society. Here’s what he had to say on LinkedIn:

2️⃣ New Jobs…Not So Fast

The Bureau of Labor Statistics reported this week that 147,000 new jobs were added to the economy last month – higher than expected. But before you get too excited and start applauded the job gains, check out what Elizabeth Renter, senior economist at NerdWallet, had to say:

Half of the new jobs added went to state and local governments. While these are real jobs, they don’t necessarily point to a healthy economy. The Wall Street Journal reports:

Last month, businesses added 74,000 new jobs, an anemic number compared with previous months. Private-sector job growth fell to the lowest level since October 2024. Of the 147,000 total new jobs added in June, nearly half were in government, bolstered by a jump in state and local government jobs.

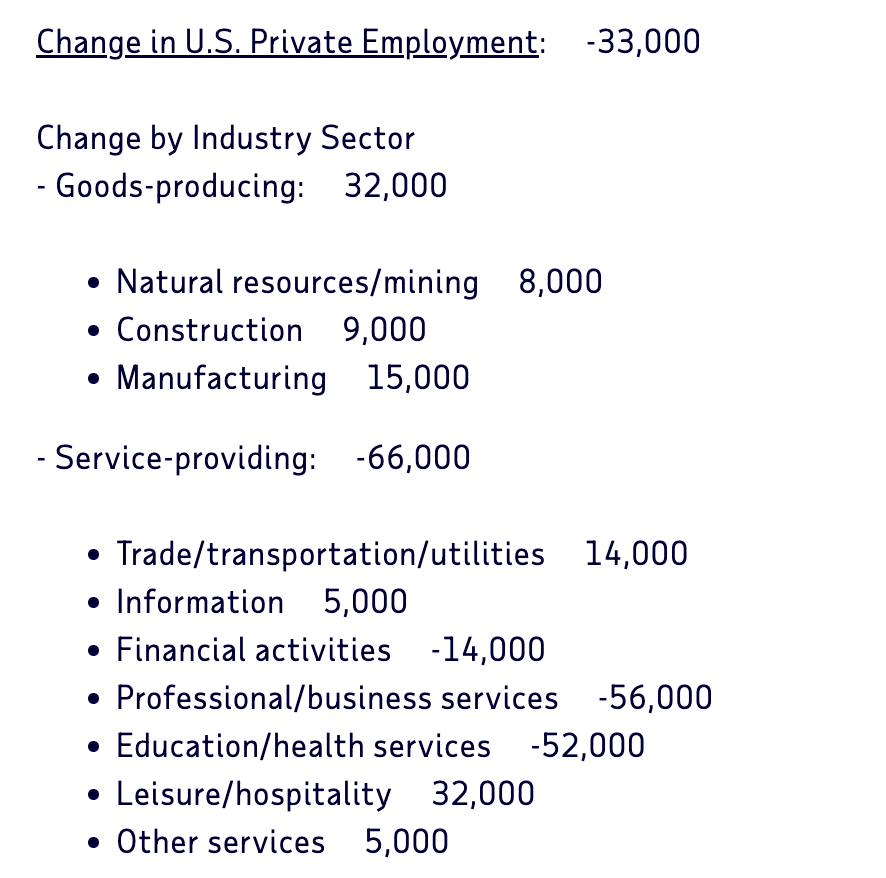

According to ADP, a major HR payroll provider, the private sector lost 33,000 jobs in June. The bulk of job losses were in professional/business services and education/health services.

This is notable because ADP’s National Employment Report shows continued concentration of employment in these sectors. As I wrote about back in 2024, whatever job growth is happening in the economy has largely been concentrated in just three sectors:

While the headlines have been filled with news of layoffs in tech, the vast majority of jobs in the last six months have been created in health care and social assistance, the government, and leisure and hospitality. (Tomorrow Today)

This tells me two things:

The labor market isn’t actually growing. Low-paying service jobs – think hotel workers and home health aides – may be in demand, but the types of jobs Gen Z grads and laid off mid-career workers expect to find aren’t being added to the economy.

The top industries employing workers in the private sector are highly exposed to AI. Professional business services is a catch-all category for white collar work. It includes things like consulting. Job losses here suggest employers are moving to leaner workforces in anticipation of greater AI adoption in the next year or two.

Other data from the Bureau of Labor Statistics suggests that whatever new jobs are currently available likely added aren’t high paying jobs. The Bureau of Labor Statistics reported in its Job Openings and Labor Turnover – JOLT – report that the majority of new job openings posted in May were for food services:

The number and rate of job openings were little changed at 7.8 million and 4.6 percent, respectively, in May. The number of job openings increased in accommodation and food services (+314,000) and in finance and insurance (+91,000).

Net job gains are good political wins but they don’t actually show what’s happening in the economy. Not all industries are adding jobs and the industries that are might not be adding jobs that the average person needs to live off of.

3️⃣ A $30 Minimum Wage is Coming to LA, Possibly New York

Speaking of a living wage, I’d be remiss not to talk about the rising popularity of a $30 minimum wage.

During his mayoral campaign, Democratic nominee Zohran Mamdani promised he would raise the minimum wage to $30 an hour but it looks like the city of Los Angeles has beaten him to the punch.

In May, the city council voted to boost the wages of hotel and airport workers ahead of the World Cup and the Olympics. The Wall Street Journal reports:

The city council voted last month to boost the wage for workers in hotels with 60 rooms or more. Hourly pay, currently $20.32, will increase every year until it reaches $30 in 2028.

While living wage advocates are thrilled, the hotel industry is in revolt. Some hoteliers are threatening to pull blocks of rooms already reserved for the Olympics while others are threatening to sell off some of their properties and pull out of the LA market altogether.

From an economics perspective, the math doesn’t math when it comes to giving unskilled laborers higher wages. If all goes to plan, by 2030, housekeepers in LA hotels will make more than preschool teachers.

Higher wages will skew the labor market, pushing workers out of skilled jobs – like taking care of toddlers – and into unskilled jobs like hotel housekeeping. This is something I’ve observed first hand. When I lived in North Carolina, I worked at a Waffle House. One of the servers on my shift used to be a preschool teacher but left because she made more money serving waffles at Waffle House.

People will absolutely move to jobs where they can make more money, disincentivizing workers from developing the skills or obtaining the certifications needed for skilled roles.

Higher wages are inflationary and will result in job losses. Consumers won’t want to absorb the costs that will inevitably be passed on to them and some small businesses won’t be able to cope. Employers who don’t want to deal with the added cost of paying a higher minimum wage – or simply can’t afford to – will just close up shop like this bakery did when Seattle increased its minimum wage.

While boosting minimum wage roles is a savvy political move in the short-term it could do real harm to local economies in the long run. Once people and businesses leave LA, I don’t think they’ll be back.

4️⃣ Corporations Are Coming to Harvard

I noted in a newsletter from last month that the Trump Administration has been going after Ivy League universities. The administration froze $2.2 billion in grants and $60 million in contracts at Harvard.

This is bad business for America’s top university. The Wall Street Journal reports Harvard has lost so much funding, it’s now courting corporations to fill the gap:

The T.H. Chan School of Public Health at Harvard, which typically gets more than 70% of its annual research dollars from the federal government, lost nearly all of the funding after the Trump administration canceled hundreds of the university’s research grants and contracts. The school expected to get more than $200 million this fiscal year.

Looking to fill the funding gaps, faculty, trustees and administrators at Harvard, New York University and other large research universities are ramping up conversations with big technology and pharmaceutical companies in efforts to drive more corporate funding so research stays active.

Universities like Harvard are major employers in the communities they are part of and elite universities are pipelines to top employers across the country. The loss of funding and broader changes to higher education are highly disruptive.

But does corporate funding solve the problem?

In the short-term, it will fill immediate funding gaps, allow researchers to continue doing their research, and protect administrative jobs. But in the long-term, it could further degrade the value proposition of elite universities, the college system as a whole, and public trust in these institutions.

Corporate interests have a stake in the outcomes of research. They have a history of using research to manipulate data or protect themselves from the consequences of their products:

Merck was caught manipulating data to prop up its arthritis drug, Vioxx. Heart complications resulting from the use of Vioxx is attributed to at least 60,000 deaths.

Both Shell and Exxon conducted internal investigations in the 1980s that revealed CO2 emissions from their gasoline would lead to global warming.

Coca-Cola funded research at the University of Colorado to divert attention away from the correlation between sugar and obesity.

While corporate funding at universities isn’t new, more corporate funding isn’t necessarily better. Researchers will do whatever it takes to protect their own interests just as large corporations will use funding to shape public opinion in favor of their interests.

Higher ed is a big business. Structural changes to how higher education is funded could impact the local economies created by universities and the social value we collectively ascribe to institutions of higher learning in the first place.

5️⃣ Amazon Employs Its 1 Millionth Robot

Amazon is the second largest private employer in the United States, employing more than 1.5 million people globally. Amazon is what I would consider a market mover – whatever Amazon does other companies will have to follow.

CEO Andy Jassy recently published a company-wide memo telling Amazon employees the company would need less of them in the coming years:

This includes warehouse workers.

The Wall Street Journal reports that Amazon warehouses are about to employ as many robots than humans:

The e-commerce giant, which has spent years automating tasks previously done by humans in its facilities, has deployed more than one million robots in those workplaces, Amazon said. That is the most it has ever had and near the count of human workers at the facilities.

Now some 75% of Amazon’s global deliveries are assisted in some way by robotics, the company said. The growing automation has helped Amazon improve productivity, while easing pressure on the company to solve problems such as heavy staff turnover at its fulfillment centers.

Robots are also supplanting some employees, helping the company to slow hiring. Amazon employs about 1.56 million people overall, with the majority working in warehouses.

While the company has trained more than 700,000 workers for new high tech roles – such as robot technicians – the writing is clearly on the wall. Eventually, robots will displace humans in Amazon factories. As the country’s number two employer, this will mean the loss of jobs in communities where Amazon warehouses are located.

As the Wall Street Journal notes, Amazon is a bellwether for AI adoption and automation within the economy. If Amazon is deploying robots and AI in its warehouses to increase productivity, it’s only a matter of time before other employers follow suit.

(Walmart, FedEx, and UPS are the first, fifth, and sixth largest private employers in the United States, respectively).

💼 Employers want AI literate workers…

But they aren’t going to train you on how to use AI. That’s something you’ll have to do on your own.

I asked ChatGPT what I need to learn if I want to become AI literate. Here are the five key domains ChatGPT thinks you should be competent in:

Foundations of AI

Technical Fluency

Practical AI Tool Usage

AI Ethics, Bias, and Policy

Application Domain and Critical Thinking

To be AI literate, you need to know how AI works, how to practically use AI-powered tools, and making decisions about whether or not it makes sense to deploy an AI-powered solution in the first place.

I asked ChatGPT to come up with a self-paced curriculum for me. Here are few courses ChatGPT recommended:

There’s a lot of different platforms you can use to become AI literate but Coursera is my favorite. They offer specializations from elite universities and you can earn certificates to prove your competency.

Coursera Plus gives you access to thousands of courses in Coursera’s catalog. It’s $59 per month but if you enroll in an annual plan it’s $399.

Coursera Plus plans are 40% off until July 21 for Tomorrow Today readers. Click the button below to enroll in Coursera Plus for just $240 and take a few courses to become AI literate.

📽️ Last Week’s Top YouTube Video

As I’ve shared in previous newsletters I’m working on building a YouTube channel. I need 1,000 subscribers and 4,000 watch hours to qualify for ad sharing on YouTube. If you enjoy my essays here on Substack I’d love it if you’d help me work towards this goal too.

📚Last Week’s Subscriber Articles You Missed

If you’re a Tomorrow Today subscriber, continue reading to the bottom for an update on this.

📩 Subscribe to Tomorrow

Stay informed with independent analysis on major shifts shaping our future. As a subscriber, you'll get exclusive weekly insights you won’t find anywhere else. Subscribe today to read all of the essays in the Tomorrow Today library.