1️⃣ AI is Transforming Access to Information

The AI revolution is underway and one sector of the economy where AI is poised to have a tremendous impact is in the media.

This shouldn’t come as a surprise. Layoffs have been happening in the media for a while now. Buzzfeed attributed AI to a round of layoffs in 2023, while Dotdash Meredith – owner of PEOPLE, Better Homes & Gardens, and Food & Wine – announced a round of layoffs earlier this year due to AI.

But now the pace of layoffs is picking up. This week Business Insider announced it would be reducing its headcount by 21% as it goes “all-in” on AI. And The Gray Lady announced it has inked a licensing deal with Amazon.

Most people think AI is being swapped in to replace writers and editors. In some cases that may be happening, but that’s only on the surface. The role of the media itself and how you access information is also changing thanks to AI.

Think about it: why do you need to maintain a massive newsroom when you can use AI to re-purpose your existing content library and generate revenue from your archive?

AI is flipping the entire media business model on its head. Instead of relying on revenue from subscribers or advertisers – revenue streams that have been dwindling – publications like The New York Times can now sell the rights to their archives for a fat fee.

That’s kind of brilliant but also makes a lot of journalism jobs irrelevant. Which might not seem like a big deal – newspapers have been dying for a while now – but it changes how you and I access information.

If AI can be used to parse through memos, official statements, and public records, you won’t need a scrappy journalist to comb through all of that information for you. The “news” you’ll get moving forward will be filtered through AI. And because there’s a profit incentive to drum up engagement, you’ll get access to the most engaging information – not necessarily the information that’s the most important.

AI isn’t just replacing human workers, it’s disrupting the business models that up until now, employed humans. The new business models that emerge will shape the economy moving forward – not just AI.

👉Be mindful of the information you consume and where it comes from

Bias in the media isn’t new. But it will become increasingly harder to distinguish in a world of AI. And because bias sells, it may become more amplified as the media business model changes.

Start noticing your sources of information. Who’s writing the articles you’re reading? What is their incentive for doing so? And more importantly, how are they getting paid?

The more disconnected you are from the source of where your information is coming from, the easier it will be for someone to manipulate the truth.

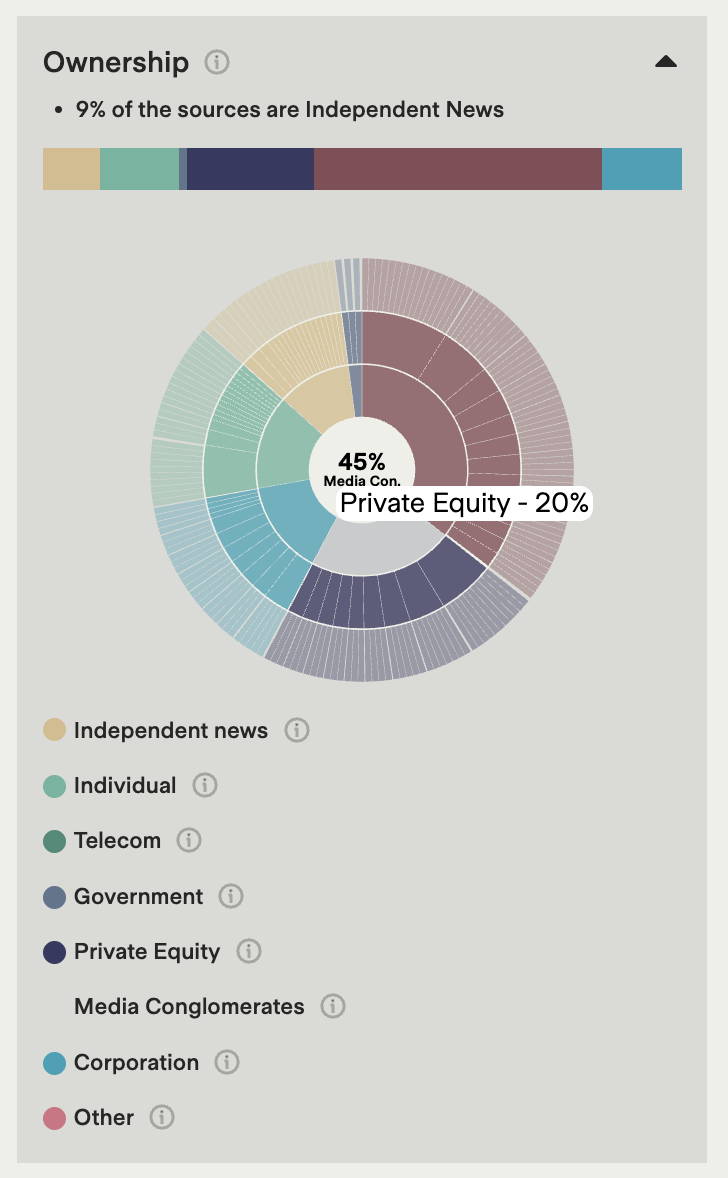

I use Ground News not just to stay up to date on the news but to see where information is coming from. It tracks political bias as well as outlet ownership.

Only 9% of the sources for this story about Trump’s tariffs, for example, came from independent sources. The majority of outlets reporting on this were media conglomerates or private equity. I had no idea private equity even played a role in media distribution until I started using Ground News.

Check out Ground News for yourself. Tomorrow Today readers can get 40% off the Vantage Plan. It comes down to $5 a month which is officially cheaper than a latte.

2️⃣ Work at American Docks is Drying Up

At the beginning of the month I talked about how product shortages resulting from Trump’s tariff policy would result in job losses.

It looks like that has come to fruition. The Wall Street Journal reports that tariffs on China have reduced the number of containers arriving at ports in Southern California. This has reduced the amount of work available for just about everyone who has a hand in the movement of goods around the country:

A reduction in containers flowing into the ports means fewer hours for dockworkers and warehouse employees and fewer loads for truckers such as Diaz. It also means less business for local restaurants, truck dealerships and repair shops, whose owners and managers say they are cutting hours and staff.

But this isn’t limited to dock workers and truck drivers. This has a ripple effect across local economies too. As The Journal reports:

Local business owners said that when logistics workers pull back on spending, they, too, have to cut back on hours and workers.

Vincent Passanisi, whose Long Beach-based company, Santa Fe Importers, supplies Italian meats and cheeses to more than 1,000 local stores and restaurants, said revenue is down 15% to 20% as logistics workers and related companies in the region pull back on spending because of tariffs.

Because of the slowdown, Passanisi has reduced the hours of his roughly 50 manufacturing workers by 20%. He has also started sending staff who work at Santa Fe Importers’ deli counter home early because of the drop-off in dockworkers, truck drivers and port tradespeople picking up sandwiches and pasta dishes to go.

According to the Los Angeles County Economic Development Corp, trade and logistics provides $500 billion in economic input across the region. For perspective, Hollywood’s entertainment industry only contributes $43 billion in wages to the LA economy.

Trade and logistics isn’t just a core part of the U.S. economy, it’s essential for cities that have built their economies around ports. You might not think of Southern California or New York/New Jersey as major hubs for trade, but they are. Because of the metro areas these ports are located in, as demand for labor declines locally, it will ripple out across the national economy.

👉 Pay attention to how your local economy relates to trade

As I’ve said before, there are second and third order consequences of tariffs. Some are good, some are not so good. You could work in a seemingly “safe” job that has nothing to do with trade and still feel an impact.

Understand what your risk exposure is. Look at how your company handled the 2008 Financial Crisis to get insight into how they will handle future economic downturns. If you can, ask your leadership what their plan is to mitigate economic risks.

That’s why they’re paid the big bucks after all. It’s their job to protect the business that employs you. If they don’t have a plan in place that might be a good sign to come up with a plan for yourself.

3️⃣ Gen Z’s Debt Strike Will Eventually Strike Back

America has a debt problem. But it’s not the whopping $18.2 trillion Americans hold on their personal balance sheets that’s the issue. It’s the fact that Americans aren’t paying off their debt.

Delinquencies are rising. Almost 24% of student loan borrowers with payments due are behind on their payments. Meanwhile, buy now pay later app Klarna reported it’s consumer credit losses are up by 17% since 2024.

Americans are falling behind on debt. For some people it’s because the cost of living is too high. But for others, it’s a choice. Once Gen Zer went viral after stating she is no longer going to pay her debt, calling for others to join her in a debt strike:

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

While I can definitely resonate with the frustration of being in debt, there are serious repercussions for people who ignore their debt and choose not to make payments on it.

Delinquencies are reported to the major credit bureaus and stay on your credit report for seven years.

Back in 2018, I opened a credit card for a business. A year later, my business partner tapped out and left me hanging. I didn’t know the business credit card was tied to my personal Social Security number and that it was reported on my credit. I didn’t know what to do when my business partner went AWOL so I missed two payments.

That was a very bad decision on my part.

JP Morgan not only reported the delinquency to the credit bureaus, they simultaneously closed two personal credit cards I had with them. In an instant, JP Morgan wiped out tens of thousands of dollars in available credit I had. If the delinquency wasn’t bad enough, my credit utilization skyrocketed, tanking my credit score.

It hasn’t been a full seven years yet so I’m still in credit purgatory. While I have decent credit, let's just say it’s not where it used to be.

Whether you like it or not, your credit score is a big deal. It doesn’t just affect your ability to buy a home. It affects a lot of things:

Buying a car

Getting car insurance for that car

Renting an apartment

Setting up utilities for that apartment

Getting a job

If enough Gen Zers follow this girl’s lead, they are going to be in for a world of hurt. If the Gen Z unemployment crisis isn’t bad enough, this will completely lock them out of the economy.

👉Don’t be stupid

I have a lot of thoughts on debt. I think exploitative and designed to keep most of us in a submissive state right on the cusp of poverty.

But that doesn’t mean you shouldn’t pay your debt. Economies are built around trust. Trust is measured by your credit score. It’s one thing to not be able to make a payment on your debt. But it’s something entirely different to choose not to make payments.

If you choose to stop paying your debt, it signals to everyone else that you’re not responsible or trustworthy. Landlords won’t want to rent to someone who’s at a high risk of skipping out on their monthly rent payment. (More on that in a bit).

If you need help coming up with a game plan to manage your debt, these are some of my favorite books on finance and economics.

4️⃣ What Trump vs. Harvard Accidentally Reveals About the Future of Work

President Trump is going after the Ivy League. Since taking office in January, President Trump has issued directives to curtail antisemitism and DEI policies on college campuses across the country. The concern is that students are ideologically captured and taxpayers are footing the bill.

In March, the Trump administration pulled $400 million in federal funding from Columbia. Last month, the administration announced it would freeze $2.2 billion in grants and $60 million in contracts to Harvard.

Aside from pulling university funding, the Trump administration is also revoking visas and detaining foreign students who have been participating in campus protests. This has raised awareness of international students on American college campuses. While that doesn’t have anything to do with the state of work, it may inadvertently shed light on barriers American workers are facing when it comes to accessing good, high-paying jobs.

It’s not a secret that graduates of elite universities have some of the best job prospects in the country. Your chances of landing a job at Google are much higher if you graduate from Stanford than the University of South Dakota.

Harvard is one of the best schools in the country and is incredibly difficult to get into. According to The Crimson, Harvard received 54,008 applications for the Class of 2028. Of that number, only 3.59% were accepted. These spots aren’t going to the brightest students in the country though. They’re going to students who can pay for the cost of attendance – a whopping $86,926 – out of pocket.

An essay published in The Free Press notes that 27% of Harvard’s student body is foreign. While the media has been framing the Trump administration’s attack on Ivy League schools in the context of free speech, I don’t think that’s actually what this is all about. At the essayist in The Free Press wrote:

But I do think these numbers—and Harvard is hardly unique—point to a real problem: Elite American universities are reluctant to be seen as American, or to prioritize American interests, even as they happily accept American taxpayer dollars. Rather, they increasingly cast themselves as global universities, educating “global citizens.”

It’s clear Harvard isn’t a school for Main Street Americans. Only 19% of Harvard students receive Pell Grants after all. But the prevalence of international students within Harvard’s student body reveals something else. Because access to the job market is tied to academic credentials, this means access to the American job market isn’t for Main Street Americans anymore.

David Graeber talks about class and socioeconomic barriers to entry for the job market in Bullshit Jobs. He notes that there’s an elite group of people who protect their industries for themselves. Just look at Hollywood. How many celebrities got their start because a parent or an uncle was already involved in the industry? A lot.

Angelina Jolie’s children are going to have a far better chance of becoming actors and film producers than any of us.

I think we all know wealthy people get preferential treatment at elite American universities. But what the ongoing protests reveal is that non-Americans are getting preferential treatment too. Those students are not only causing disruption within American society, but they’re taking spots that could have gone to high-performing students from Main Street.

👉 Food for further thought

International students enrich college campuses. I made friends with international students when I was in school and I myself was an international student after I graduated from college.

But given the changing nature of the world, I think there are some important questions that need to be asked.

Who are we educating and for what purpose?

If an international student who studied at Harvard stays in the United States after they graduate, they take a job from a qualified American who went to a lower status university. And if they leave, they take their human capital with them. Human capital that could have been invested in a Main Street American had they been given a shot at an elite school.

If Main Street Americans can’t compete for spots at top schools and those schools are feeders for top employers, what does this say about the average American’s access to the job market? And if Main Street Americans can’t compete for spots at top schools on the basis of merit, then what’s the point? Why participate in a game you have no chance of winning in the first place?

While there is certainly still value in the college-career pipeline for a lot of professions, that’s not the case for every student. There’s a lot of reasons why the college system is breaking down, but the prevalence of international students on American campuses is interesting to think about.

Some diversity is good and not all international students are studying in the U.S. with the intent of taking American jobs. But how much is too much? If there’s a profit incentive for universities to increase the number of international students in their student body then that’s what they’re going to do.

The role of college is rapidly changing. This is an interesting dynamic that really isn’t being discussed. I’d love to know your thoughts on this.

5️⃣ More People Are Selling Homes Than Buying Them

According to Redfin, more people are selling homes than are in the market to buy them. If you learned anything from Econ 101 it’s that as supply outpaces demand, prices fall.

Per Redfin’s analysis it’s a buyer’s market:

At no other point in records dating back to 2013 have sellers outnumbered buyers this much.

While this might be a good thing for buyers there’s just one problem – there aren’t any.

Gen Z and Millennials have no money. And the handful who do are getting priced out of the market.

Existing homeowners don’t have a reason to trade up. Even if you have a growing family and want a bigger house, high interest rates have made monthly mortgage payments unpalatable.

That leaves only one group of people in the market left to buy homes: landlords. As I wrote in the Gen Z Employment Crisis series:

The only people who can afford to buy homes are landlords who think they can turn a profit by renting them. But that is hard to do on a $417,000 home with a 7% 30-year fixed mortgage. Depending on where you live, even BlackRock might not want to buy your home. (Tomorrow Today)

But even landlords aren’t a guaranteed market.

A former landlord posted a video on X, highlighting the risk landlords face. If your tenant doesn’t pay rent, you’re still on the hook for the mortgage of the property.

With living costs rising faster than wages, tenants can’t keep up. He points to debt triage to identify when the housing bubble could burst:

They’re gonna stop paying credit cards first. Then it’ll be car payments, and then it’ll be whatever else they can cut out of their budget.

As I alluded to above, this is already happening. Credit card delinquencies are up from pandemic-era lows. A growing number of people are behind on car payments. Klarna is struggling to collect on its microloans and one in five student loan borrowers is "seriously delinquent.”

People have run out of things to cut out from their budgets and they’re falling behind on what they owe. If the current housing volume is being driven by landlords selling rental properties to get out of the market, that’s a good sign a major economic crisis is imminent.

Maybe I’m missing something, but other than institutional investors – both in and outside of the U.S. – I don’t know who has the cash to afford real estate. This feels like a bubble that’s waiting to burst and if 2008 taught us anything, it’s that whatever happens to the housing market could have catastrophic repercussions across the rest of the economy.

👉Pay attention to your local housing market even if you’re not in the market to buy a home

Like transportation, housing is a core pillar of the American economy. Weakness in one market, however, may not signal weakness everywhere.

Take a look at the number of homes coming to the market, how long it takes for them to sell, and the median home price. This can be a useful metric to gauge the health of your local economy.

📚Last Week’s Subscriber Articles

The Gen Z Employment Crisis (Part 4) – Economic Impact

This is a subscriber-only essay in a four-part series about the Gen Z employment crisis. Become a subscriber to read the full series.

What You Need to Know About Worldcoin

When you hear Sam Altman’s name, you probably think of him in the context of OpenAI, the company that’s more or less pioneering the public-facing side of the AI revolution. But Sam Altman is more than just a tech CEO.

📽️ Last Week’s YouTube Videos

📩 Become a Tomorrow Today Subscriber

Stay informed with independent analysis on major shifts shaping our future. As a subscriber, you'll get exclusive weekly insights you won’t find anywhere else. Subscribe today to read all of the essays in the Tomorrow Today library.

Tomorrow Today is a member of several affiliate programs, including Amazon’s. If you click a link and make a purchase, Tomorrow Today may earn a commission. Thanks for your support.

Very thought provoking as usual, Amanda!

I have an optimistic view regarding your first point on information. As large scale news gathering sources become unprofitable & automated, other new outlets have arisen. Many of our great journalists are on Substack (Michael Shellenberger, Matt Taibi, Alex Berenson) and X (Catherine Herridge & Mike Benz). I feel like I get better stories than ever from these now independent journalists.

On AI, I also take an optimistic view. I highly recommend the All-in podcast discussions on this topic. I've learned so much from the besties. Last Friday's episode talked about AI increasing the amount of capital available for investment. AI also allows faster startups with fewer resources. Their perspectives are fascinating. No doubt the impact on individuals will be difficult but AI will be a boon to the overall economy.

Thanks for the great post.