The Latest Jobs Report Shows the Economy is Doing Much Worse Than You Realize

The data tells a very different story.

A new jobs report came out last Friday. With natural disasters in the American south and a dockworker strike on the east coast, analysts weren’t too optimistic about the numbers.

But 12,000 jobs? Surely the American economy is doing better than that.

Unless, of course, it really isn’t. According to the latest figure, this is the lowest number of jobs that have been added to the economy since 2020.

Job growth is an important indicator of how well an economy is doing. It’s not so much about the number of jobs that are created rather what that number represents.

A high number of new jobs added on a consistent basis suggests the economy is capable of creating new employment opportunities. When people are employed they spend money. When people spend money, companies turn a profit. And when companies turn a profit, they can invest in growing their business by hiring more people.

The sluggish addition of new jobs suggests employers aren’t able to grow their businesses in a way that leads to new employment opportunities for workers. Maybe the economy isn’t as strong as the media or Wall Street suggests it is.

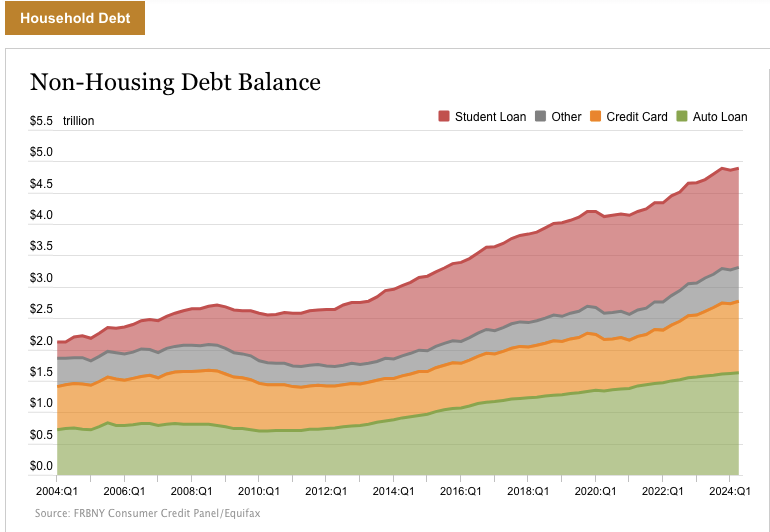

Existing data from the Federal Reserve Bank of New York confirms Americans are increasingly relying on debt – rather than income from a job – to get by. Credit card debt is a whopping $1.14 trillion and saw a 5.8% increase from 2023.

Whatever employment opportunities do exist aren’t affording workers the means to cover their daily living expenses. When you look at the latest jobs report in the context of other economic data like consumer debt, it’s clear the economy doesn’t have the fuel it needs – consumer spending – to keep going.

The inability to create new jobs suggests the economy has hit a point of stagnation. While the United States may have made a soft landing, it’s unlikely to stick.

This essay will dive into the latest jobs report to parse through what the economy is actually doing. It will show that job growth is too concentrated, mostly in unproductive sectors of the economy.

More importantly, this essay will argue that because jobs are only being added to a handful of industries, expectations aren’t matching reality. Workers – many of whom financed expensive educations to become employable – aren’t finding jobs where they expect them to exist.

Combined with other factors like inflation and the rising cost of living, the economy is creating the conditions for prolonged stagnation. The consequences of this are more than economic and will likely have a deleterious impact on American society for years to come.

This essay dives into:

⚡ Why the economy isn’t adding new jobs and how this is covering larger structural problems within the economy

⚡ Where job growth is concentrated and how this affects employment opportunities

⚡ Why you should be skeptical of official numbers — they don’t always paint a complete picture of what’s happening on Main Street

⚡ How government intervention is disrupting supply and demand signals, leading people to pursue careers where jobs no longer exist

☕ Support independent analysis like this to get a different perspective on the economy.

Your support makes it possible to ask thought-provoking questions. Become a subscriber to access new articles and contribute to the conversation.

Don’t just consume the news — help shape it.

The economy is adding jobs but they’re not productive

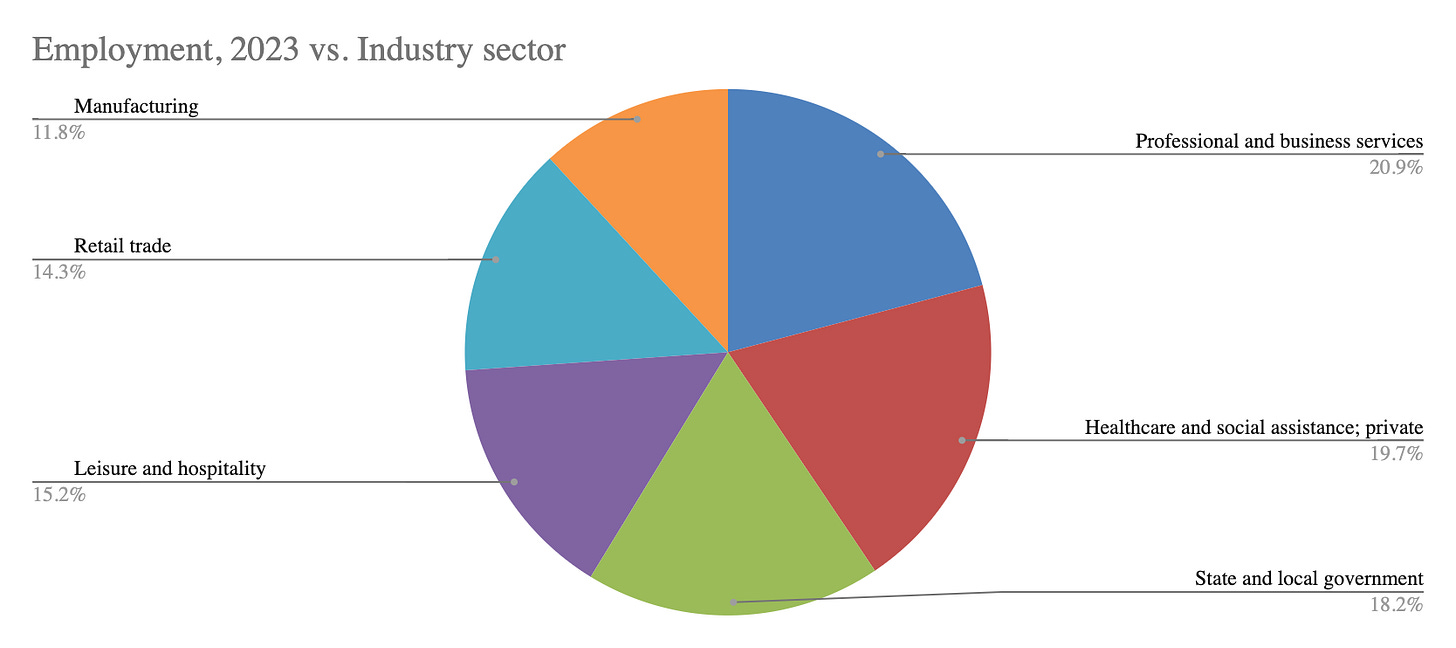

Six industries dominate the American labor market: professional and business services, healthcare, government, leisure and hospitality, retail trade, and manufacturing. Combined, these industries account for more than 109 million jobs or 65% of all jobs available.1

The largest sector – professional and business services – is a catch all for white collar work. This encompasses everything from attorneys to management consultants to engineers. The vast majority of young people who graduate from college are vying for a job in this industry.

Yet jobs aren’t being added where they’re expected or needed. According to the latest jobs report, new jobs were added in just two sectors of the economy: health care and government. Analysts at JP Morgan report:

In October, the increase in nonfarm payrolls was primarily fueled by sustained growth in the health care (+52,000) and government (+40,000) sectors. (JP Morgan)

This is in line with previous labor data I reported on at the beginning of the year. ZipRecruiter found that 96% of jobs added in 2023 were concentrated in government, healthcare, and leisure and hospitality.

Consistent growth in government and healthcare payrolls suggests the economy is doing far worse than most people realize.

The government isn’t productive. It doesn’t provide anything of value or add to the country’s GDP. If anything, government jobs are a hidden tax on the American people. The funds to cover government salaries comes from taxpayer dollars.

I previously worked as a defense contractor in Washington, DC where I was responsible for awarding contracts for a $10 million training and equipping program. Overhead – or the cost of paying subcontractors to implement the program – was around 40%. Even though my salary was paid by my employer, the funds my employer used to pay me came from a different government-funded contract.

Adding government jobs to bolster the monthly jobs report obfuscates the real problem – the economy isn’t actually adding jobs to begin with.

The other industry that posted new jobs in October was healthcare. Again, this isn’t necessarily something to celebrate.

The American healthcare system is actually a sickcare system. It’s a revolving door of expensive treatments that are designed to keep people sick.

Many of the jobs being added are at the low end of the pay scale. They’re administrative roles or low-paying assistant positions. I’d hardly call the addition of new home health aides a win for the economy.2

In other industries, the economy is actually shedding jobs. Manufacturing, unsurprisingly, continues to get pummeled. JP Morgan analysts report:

Manufacturing jobs (–46,000) posted the largest decline since April 2020. This downturn was largely attributed to a decrease of 44,000 jobs in the transportation equipment manufacturing sector. The decline was primarily driven by the ongoing dockworkers’ strike, which disrupted trade on the U.S. East and Gulf coasts. (JP Morgan)

The jobs report highlights raw job growth but that isn’t indicative of a healthy economy. The types of jobs being added is arguably more important.

Just like an employer would want to hire a productive employee, the national economy needs to add productive jobs. The consistent addition of new jobs in healthcare and government reveals the economy isn’t adding the jobs that are actually needed to get the economy flowing again.

Even though the jobs report shows new jobs have been created, fewer workers are actually employed

The other prominent data point highlighted in the monthly jobs report is unemployment. This figure, like the jobs figure, doesn’t accurately portray what is really going on in the economy.

Unemployment is measured by asking 60,000 people whether or not they are employed. It does not represent the entire population nor does it take into account variances in employment status such as underemployment.3

Personally, I’m skeptical about how this data is collected. I’m 33 years old and have worked a patchwork of jobs over the last few years. I’ve never interacted with a Census worker much less been asked about my employment status.

I don’t know a single person who has been polled about their employment status. Do you? Whoever is being sampled doesn’t seem to be indicative of the economy at large.

Another dataset generated by the Bureau of Labor Statistics suggests far fewer people are actually employed than the jobs report reveals. According to the household survey, 368,000 people reported a change in employment status from September to October 2024.

The Wisconsin-based MacIver Institute reports:

The HHS shows that in October there were 368,000 fewer jobs than there were in September––even more than occurred in October of last year. Going back to February 2023, the ES has failed to show job losses in 7 of the last 21 months, and has over-reported job gains a total of 13 times.

What's more, the HHS shows that the number of people in the labor force decreased by 220,000, while the number of people who dropped out of the labor force entirely increased by 440,000. (MacIver Institute)

This figure doesn’t definitively say that more people have become unemployed but it does show a clear decline in employment status.

As the MacIver Institute analysis suggests, the data reported in the monthly jobs report might be overrepresenting employing figures to give the false illusion of a strong economy. There’s good reason to believe this is happening. Back in August, BLS revised its statistics after coming clean that 818,000 fewer jobs were actually added from March 2023 to April 2024. That’s not insignificant when the average number of jobs added per year is around 1.4 million.4

Anecdotally, it seems like job losses are up rather than down. Since the start of the year, I know four people personally who have been affected by layoffs while my LinkedIn feed is constantly filled with people looking for work. Even for myself, two of my freelance writing clients eliminated their writing teams and another two cut their production in half.

While the Bureau of Labor Statistics suggests jobs are being added, it’s clear that’s not actually happening. People are losing jobs, especially in industries where new jobs aren’t being added. Combined with unreported data like underemployment, the economic outlook might actually be weaker than officials would care to admit.

Structural economic problems are likely to keep job growth stagnant moving forward

While some people are benefiting from the economy, the majority of people are not. Two groups within the labor market signal there might be bigger structural problems that will continue to have lingering consequences down the road.

Official data reports unemployment is 4.1% with around 7 million individuals out of work. That number is much higher for young people. For Gen Zers aged 20-24, the unemployment rate is almost two times the national average.

This suggests that recent college graduates who likely want to work can’t find a job. While there is a prevailing narrative that young people don’t want to work, it is also true that the jobs available don’t match their expectations or economic needs.

This was certainly the case for me when I graduated from college a decade ago. I spent my first year in Washington, DC hustling at Starbucks on nights and weekends for $9 an hour while working a series of unpaid internships. My first “real” job paid me $16 an hour to use social media to talk to people in Syria – in Arabic.

Things are much worse today. The cost of living has skyrocketed while groceries are up 28%. Young people are still expected to take low-paying jobs in high cost of living cities as they work their way up the corporate ladder. Because many entry level jobs are being replaced by automation, it’s becoming increasingly difficult for young people to land jobs in the first place.

Policy decisions are also adversely affecting workers. Around 7.2 million working age men have dropped out of the workforce. This is largely due to corporate DEI initiatives to “diversify” the workplace.

In 2023, 94% of new jobs added to S&P 100 companies went to people of color.

There’s a prevailing assumption that white men don’t need access to jobs because they’ve historically benefitted from the economic status quo. While this may certainly be the case for some white men – especially those coming from elite universities – it isn’t the case for all white men.

Structural problems within the economy suggest workers are becoming demoralized. They no longer see advantages of participating in the system. This decreases productivity over the long-term while adding new demands on public benefit programs as an alternative source of income.

We’re already seeing the consequences of young people delaying marriage, home buying, and starting families as a result of adverse economic conditions. The data coming out regarding employment prospects for Gen Z, especially young men, suggests it’s unlikely the economy will get out of a negative slump anytime soon.

Final takeaway

Despite what statisticians in Washington or analysts on Wall Street want you to believe, the economy has flatlined.

The data reports higher levels of employment than what is actually present in the economy. More people are struggling to get by than ever before. Without the creation of new jobs, it’s unlikely the economy will recover anytime soon.

This sobering conclusion raises an interesting question: how exactly is the economy supposed to create new jobs then?

The answer to that question lies in the labor market.

The labor market is regulated by the laws of supply and demand. The price of labor sends signals out to the market to indicate where there is demand for labor.

Interference in the market creates invalid demand signals.

Take college as an example of this.

The Department of Education subsidizes the cost of college to make it “more affordable.” Today young people with useless majors can finance a college education even though there won’t be a demand for their talents when they graduate.

This creates a supply of labor that is completely divorced from reality. The data show the demand for labor does not exist in the high-paying professional service industry that young people are expecting to find jobs.

Whether it’s subsidizing college degrees or overregulating businesses, it’s clear the more involved the government is in managing the economy, the more obfuscated supply and demand signals become. As a result, this makes it harder for job creators – small businesses – to actually create the new jobs the economy needs.

Looking at the most recent jobs report alongside other economic data, it’s clear the failure of the economy to create jobs is a symptom of a much larger problem. If it continues to go undiagnosed, stagnation will continue to be the economy of Main Street for the foreseeable future.

☕ Thank you Tomorrow Today subscribers for your support!

You make it possible to add thoughtful commentary like this to the media landscape. Thank you.

2023 data from the Bureau of Labor Statistics: https://www.bls.gov/emp/tables/employment-by-major-industry-sector.htm

How the Government Measures Unemployment, Bureau of Labor Statistics, https://www.bls.gov/cps/cps_htgm.htm

Job growth by year. Arizona State University. https://seidmaninstitute.com/job-growth/year/

Great work. I will add a few points to supplement this essay.

1. The Bureau of Labor Statistics would brought under the administration by Obama. It used to be independent. In July they over reported jobs created by 800,000... a record error. They had to walk it back but the corporate media had already pained a rosy picture for the Biden Administration in an election year.

2. The government reports the U-3 measure as the unemployment rate. It is currently about 4%. But the U-6 measure is the REAL unemployment rate because it factors those working in part time jobs, those with more than one job and those that have been discouraged and dropped out of looking for a job. That rate is about double the U-3.

3. There are 330 counties in the US, about 1,200 communities, that are considered labor surplus areas. The real U-6 unemployment rates for those communities is way in the double digits. For certain demographics like youth, male and black... they are much higher... in many cases being 50% or higher.

4. There is another disingenuous report of an increase in small business starts. However, 82% are non-employee small businesses... just people needing a Schedule-C for their 1099 gig economy work because they cannot find a job with an existing company.

You are correct. The private economy is not creating enough jobs to meet the needs of the citizens. The oversupply of labor compared to the undersupply of good enough jobs has put downward wage pressure on the remaining jobs. Meanwhile government has continued to increase the pay and benefits of public sector workers, thus creating a huge disparity in total compensation between public and private sector... and at the same time creating a huge merit disparity between private and public sector as the greater competition for work in the private sector has resulted in much higher capable labor. Government workers are overpaid and underqualified compared to the private sector. It is time for a reset.

Highly relevant and insightful. There are also between 1.2 and 1.9 million prisoners in the U.S., who aren't counted as unemployed, and in fact are huge financial drag on state and federal government. Ex-cons also have a very high unemployment rate, and I suspect that they aren't accounted for either. There's no doubt in my mind that there will be painful repercussions for the state of U.S. finances, not too far in the future. Thanks.